Mileage Rate 2025 Nz Ird. Commissioner's statement on using a kilometre rate for employee reimbursement of a motor vehicle. The other factor to consider is that the ird rate of 77c per km (across all makes, models, ages and engine sizes) is capped to 5,000km per year and requires keeping a log book,. The weighted average rate of 0.71975 cents per kilometre is calculated for the 2016 income year, compared to a weighted average of 0.73971 for the 2015 income year.

The claim will be limited to 25% of the vehicle running costs as a business expense. If a contractor wants to change their rate of tax they must complete a.

20192024 Form NZ IRD IR633 Fill Online, Printable, Fillable, Blank, Commissioner's statement on using a kilometre rate for employee reimbursement of a motor vehicle. Changes coming in april 2025.

IRS Standard Mileage Rates ExpressMileage, If a contractor wants to change their rate of tax they must complete a. The claim will be limited to 25% of the vehicle running costs as a business expense.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, The tier 1 rate which applies to the first 14,000 km is set at $0.76 per kilometre, while the tier 2 rate which applies where running exceeds 14,000 km is set at $0.26 for petrol or diesel. The other factor to consider is that the ird rate of 77c per km (across all makes, models, ages and engine sizes) is capped to 5,000km per year and requires keeping a log book,.

New Mileage Rate Method Announced Generate Accounting, The weighted average rate of 0.71975 cents per kilometre is calculated for the 2016 income year, compared to a weighted average of 0.73971 for the 2015 income year. The other factor to consider is that the ird rate of 77c per km (across all makes, models, ages and engine sizes) is capped to 5,000km per year and requires keeping a log book,.

20202024 Form NZ IRD IR880 Fill Online, Printable, Fillable, Blank, The claim will be limited to 25% of the vehicle running costs as a business expense. View the 2025 mileage reimbursement rates here.

2025 standard mileage rates released by IRS, Ird mileage reimbursement rates in new zealand. This includes private use travel.

IRS Announces 2025 Standard Mileage Rates Marshfield Insurance, To help in calculating an employee’s reimbursement when they use their private vehicle for work. In accordance with s de 12 (4) the commissioner is required to set and publish kilometre.

IRS Announces 2025 Mileage Reimbursement Rate, The new rates have increased from the 2025 rates for all vehicle types, particularly for petrol and diesel vehicles, which reflects the increases in. To help in calculating an employee’s reimbursement when they use their private vehicle for work.

IRS Mileage Rates 2025 What Drivers Need to Know, The other factor to consider is that the ird rate of 77c per km (across all makes, models, ages and engine sizes) is capped to 5,000km per year and requires keeping a log book,. New zealand's inland revenue (ir) has just released its vehicle kilometre (km) rates for the 2025 income year, and it’s not good.

.png)

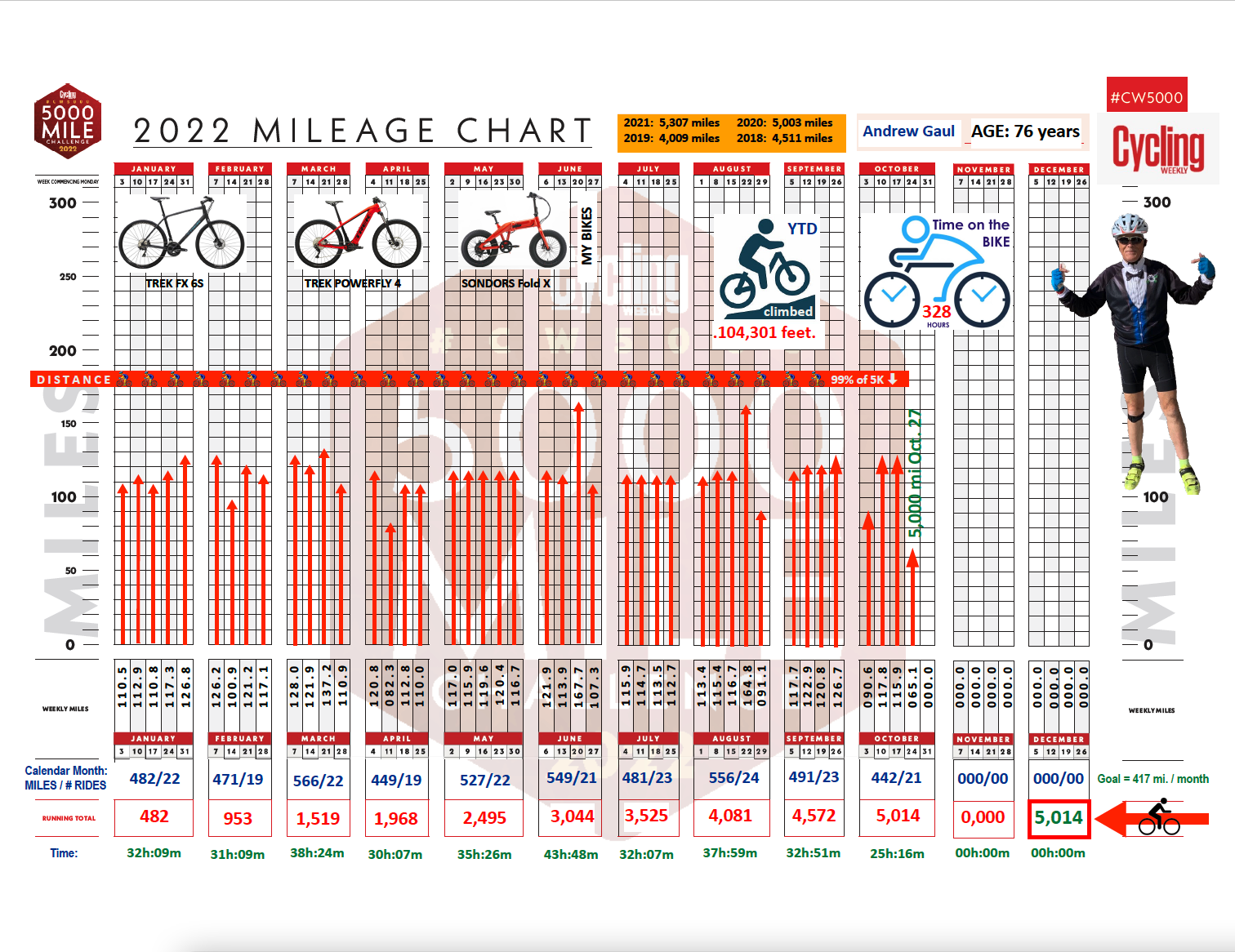

2025 Cycling Weekly mileage chart Cycling Weekly, The tier 1 rate which applies to the first 14,000 km is set at $0.76 per kilometre, while the tier 2 rate which applies where running exceeds 14,000 km is set at $0.26 for petrol or diesel. The claim will be limited to 25% of the vehicle running costs as a business expense.

So we’ve put together this extensive article, based on the offical new zealand tax guides (used by accountants) and the latest information from ird, to help you with claiming vehicle expenses.